bobcheck vs Debt Recovery Firms: What’s the Difference?

Protect Client Relationships While Recovering Missed Recruitment Fees

Traditionally, recruitment agencies who discovered missed placement fees might turn to a debt recovery firm to recoup those lost earnings.

Some may still choose that approach today. But now that bobcheck's automated fee tracking is available, many recruitment businesses are choosing a different, relationship-focused solution.

In today's post we'll explain why we'd advise caution before going down the debt collector route, and outline why bobcheck offers a fundamentally different approach to recruitment fee protection.

What is bobcheck? Automated Fee Tracking for Recruitment Agencies

bobcheck is an automated candidate tracking tool which parses through your CVs and candidates to identify back-door hires (which we also refer to as 'bobs' – hence the name!) and missed placement fees.

Most recruitment agencies simply don't have the manpower or time to manually check back through their candidate databases and keep an eye out for back-door hires.

bobcheck automates this entire fee tracking process, turning checks that would take a human many (many) hours into the work of mere moments. With bobcheck in your recruitment tech stack, you should never miss a fee again.

Did you know? We can parse through 10,400 lines of data in just six minutes! It would take a human, checking publicly available data sources, 45 DAYS to do the same.

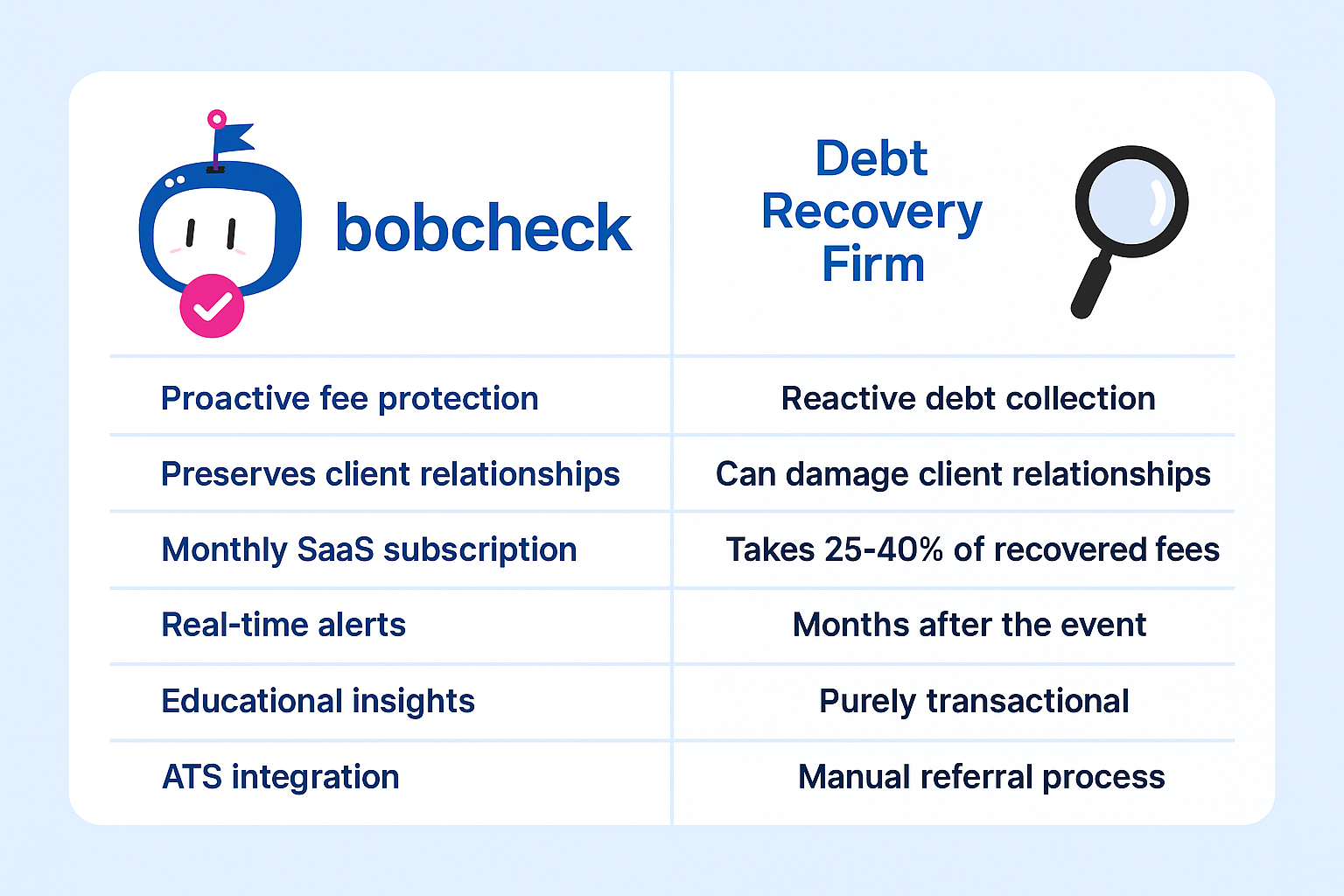

How Does bobcheck Compare to Debt Recovery Firms?

The Debt Recovery Approach

Debt collectors, or debt recovery firms, will act as a third party on your behalf to try and recover missed earnings from your client.

No doubt there are some reputable firms out there who do this work in a careful and well-managed way. But from our experience in the recruitment industry, turning to debt collectors feels heavy-handed, and can permanently damage your client relationships. We'd always recommend a discussion first, and keep debt recovery or legal action as a last resort.

The bobcheck Difference: Prevention Over Collection

Unlike debt recovery firms, bobcheck doesn't take a percentage of your missed fee. As a pure SaaS (Software as a Service) business, users simply pay a monthly subscription for automated fee tracking. With bobcheck, there's no hidden costs or taking a cut of your recovered earnings!

Key Differences:

With bobcheck's automated fee tracking, recruitment agencies get real-time alerts when a back-door hire is discovered.

Now, this is important. When a bob is identified quickly through our candidate tracking software, it puts you in a much stronger position to reach out to the client and discuss ways to recover that missed fee. Whether the fee is repaid fully, or another arrangement is made, such as exclusivity on future roles, comes down to the relationship between your business and your client.

Whichever resolution you settle on, with bobcheck's quick and simple identification process through ATS integration, you'll be in a much stronger position to negotiate and discuss with your client, finding a mutually beneficial resolution.

Real-Time ATS Integration for Immediate Fee Protection

We have an excellent API integration into Bullhorn and JobAdder that live tracks data and flags instantly when we detect a back-door hire event has happened.

Without bobcheck's automated candidate tracking, months could pass by since that initial back-door hire occurred – meaning your client relationship may have changed significantly. This means the opportunity to discuss compensating missed fees may have closed. And that's when recruitment agencies find themselves heading down the unrewarding path to debt collection…

Are you looking for more tips and ideas to protect your recruitment revenue? Download the bobcheck Revenue Protection Guide for practical advice and strategies to enhance your fee protection procedures.

Prevention and Understanding: The bobcheck Advantage

bobcheck can undoubtedly put you in a strong position to negotiate with clients and recover lost earnings in some shape or form.

But beyond fee recovery, our customers are really seeing value in using our software as a training and prevention tool too. bobcheck provides insights to help you understand why a back-door hire has occurred in the first place.

Learn From Every Missed Fee

Once the tool alerts you to a back-door hire, you can begin investigating the event. Did a team member leave and nobody was in place to follow up? Were incorrect terms attached with the job (or, worse, not included at all)?

Once you understand these patterns, you can then put measures in place to prevent future missed fees from happening again. See, in an ideal world, bobcheck wouldn't pick up on any missed fees – because your recruitment processes would be so tight, a back-door hire wouldn't happen! Now, of course, this isn't realistic. But with the learnings and insights bobcheck can deliver, you should be able to improve your processes, retrain your people and prevent future bobs.

Mind you, it's still worth keeping bobcheck parsing your data every month – just in case a back-door hire slips through the net. Think of it as your fee protection insurance policy!

Why Recruitment Agencies Choose bobcheck Over Debt Recovery

Client Relationship Protection

Your client relationships are your most valuable asset. Instead of sending a debt recovery firm their way, bobcheck empowers you to open up a conversation and find a mutually beneficial resolution.

Cost-Effective Fee Protection

Pay a flat monthly subscription instead of 25-40% commission on every recovered fee.

Proactive, Not Reactive

Identify missed fees within days, not months, when you still have relationship capital to negotiate.

Continuous Improvement

Learn from every back-door hire to strengthen your recruitment processes and prevent future fee loss.

ATS Integration

Seamless integration with Bullhorn, JobAdder, and Vincere (coming soon) means automatic candidate tracking without manual work

When should I use a debt recovery firm?

Only as a last resort when a client refuses to engage in good faith discussions about a clear missed fee. Always try direct communication first.

Can I use bobcheck alongside debt recovery services?

Yes, but bobcheck's early identification typically makes debt recovery unnecessary. Most agencies resolve issues directly with clients when alerted quickly.

How much do debt recovery firms charge?

Typically 25-40% of the recovered amount, plus potential legal fees. bobcheck charges a fixed monthly subscription regardless of fees recovered.

What's the success rate for fee recovery with bobcheck?

While it varies by agency, early identification through bobcheck gives you the strongest negotiating position. Most clients prefer to maintain the relationship through direct resolution.

Don't Go Down the Debt Recovery Route – Choose Prevention Instead

So, don't head down the debt recovery route (and don't mistake us for a debt collection firm either!). We're all about identification, education and prevention. And, perhaps most of all, we believe your client relationships are the most important thing. So instead of sending a debt recovery firm their way, open up a conversation instead, and find out if you can both reach a resolution.

With bobcheck's automated fee tracking on your side (and tighter procedures and staff training), missed fees will be a thing of the past.

Ready to protect your recruitment revenue without damaging client relationships? Learn more here

bobcheck - Automated Fee Protection & Candidate Tracking for Recruitment Agencies

Trusted by 25% of Recruiter's Top 100 Agencies