Track.

Protect.

Get paid.

bobcheck is designed to complement the strong foundation which you've built on Bullhorn, adding an independent layer of intelligence that helps agencies validate revenue outcomes, spot risk earlier, and trust their data with confidence.

No process change. No disruption. Just clarity on what you have already earned.

How does bobcheck work?

Connect & import CV data

bobcheck connects seamlessly to your ATS via API (or upload a CSV file) and imports your past year’s CV data. This means any outstanding missed fees can be spotted immediately.

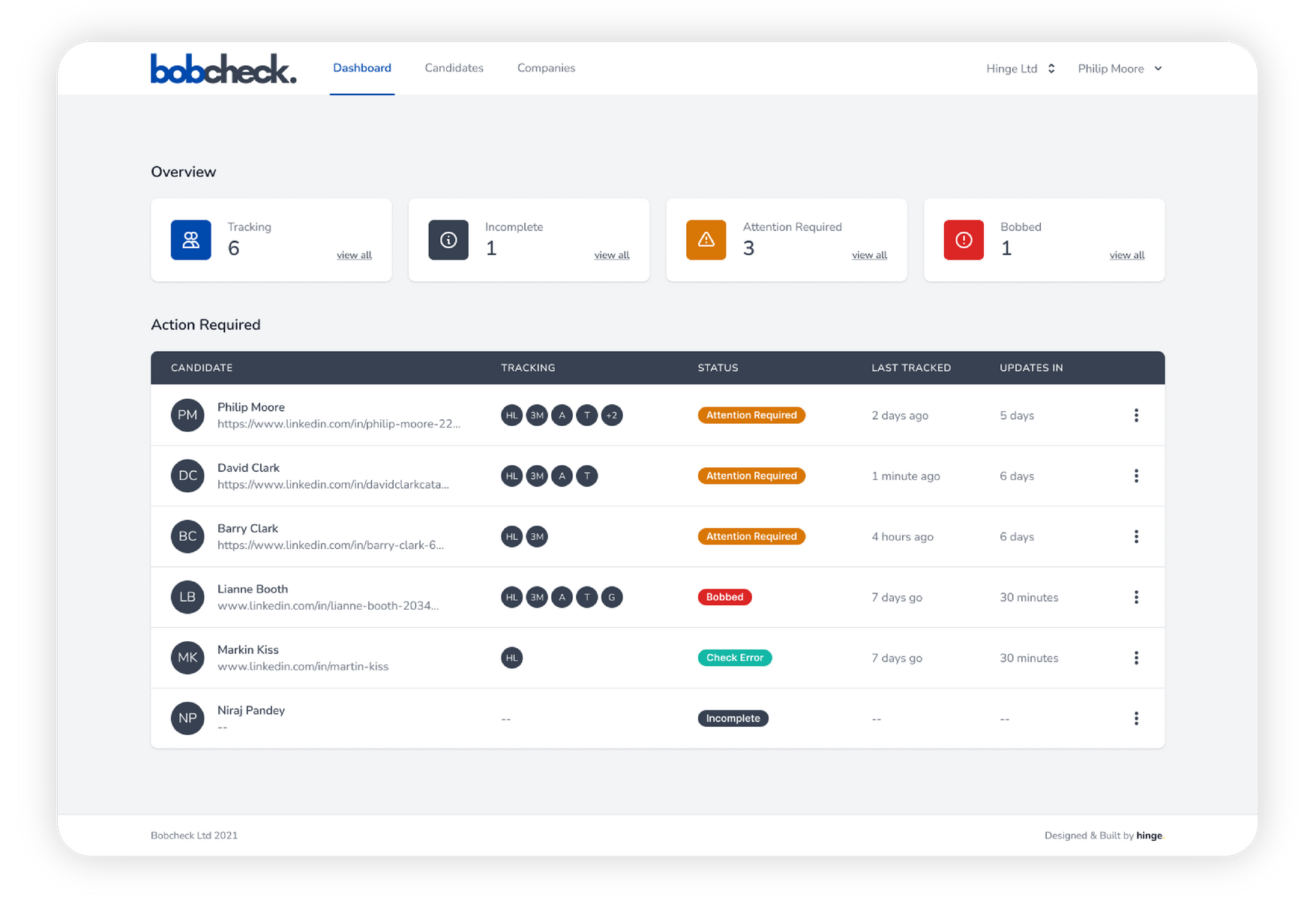

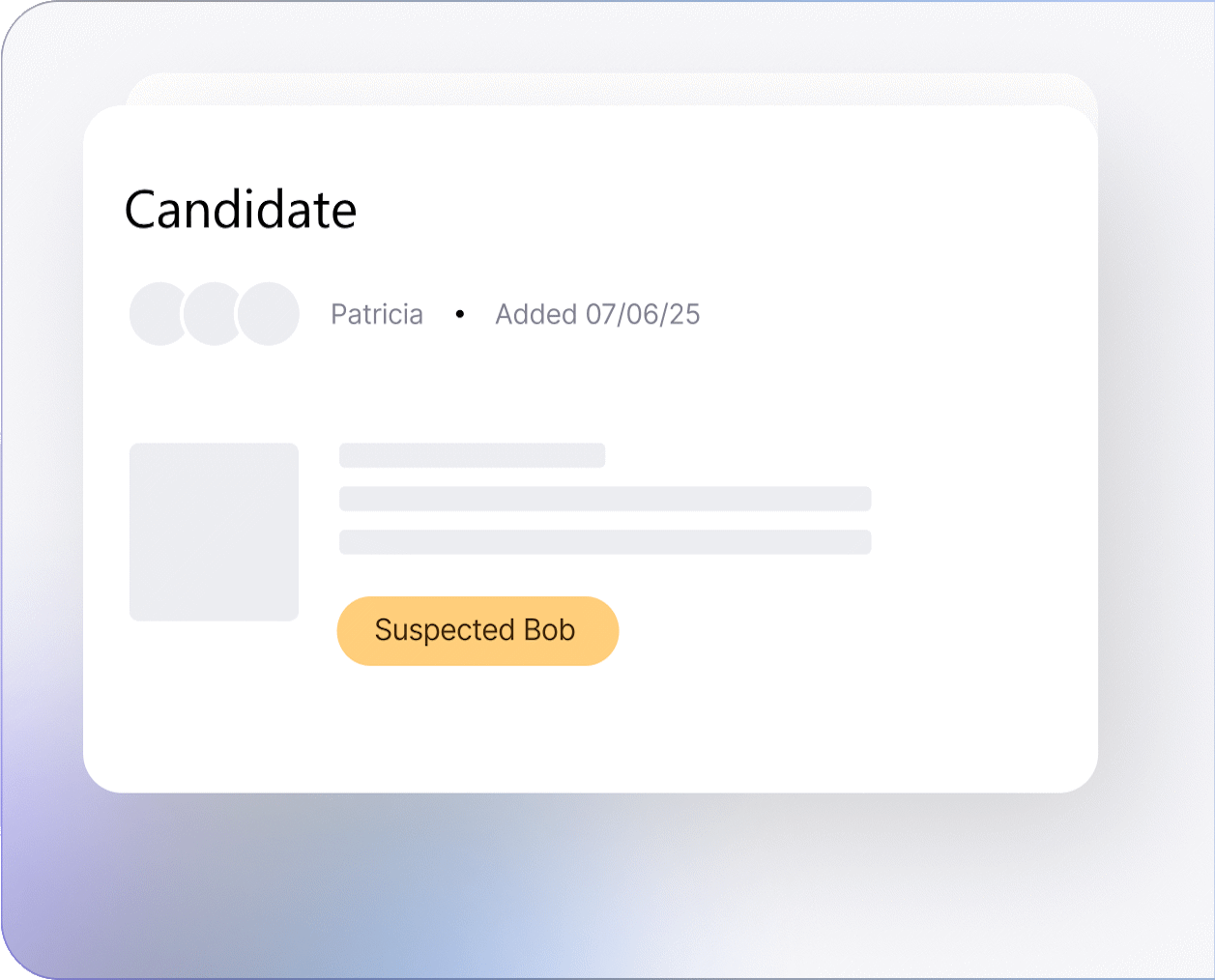

Candidate Tracking

Every day from setting up bobcheck, Bob monitors candidate movement in the background, so nothing slips through. CVs are tracked for 12 months and you're alerted if the candidate goes ‘behind our back’.

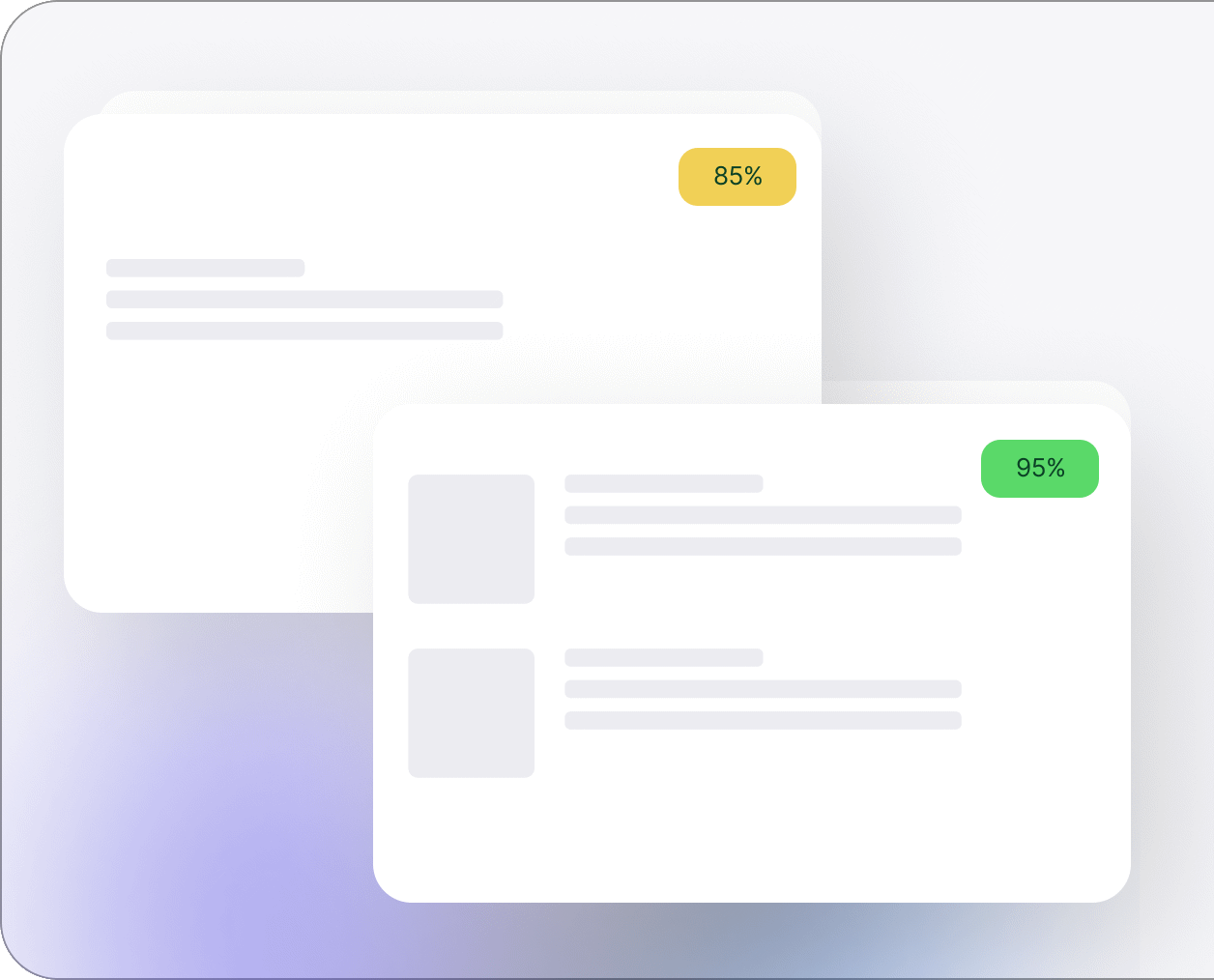

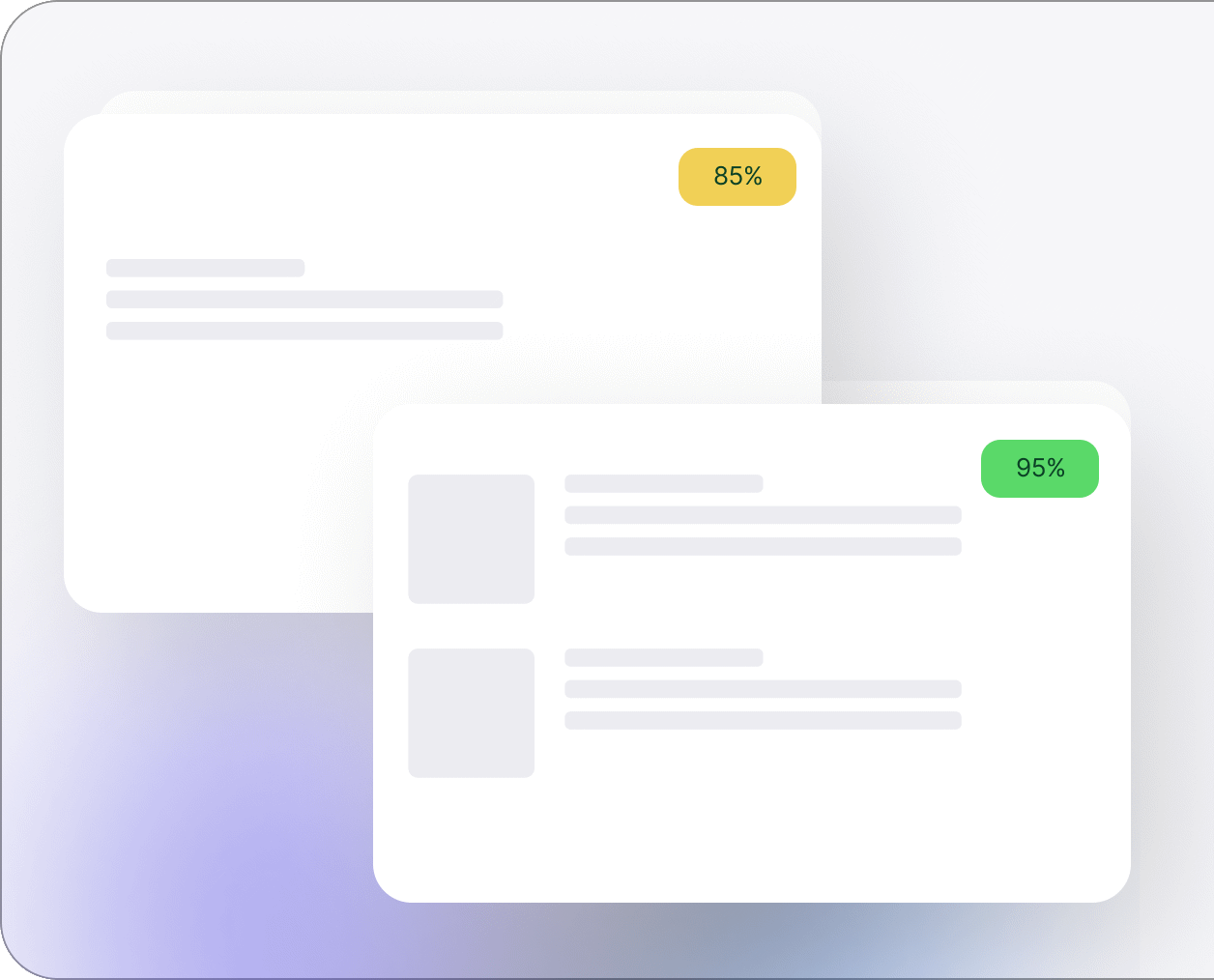

AI algorithm runs alongside

bobcheck’s AI reviews every candidate match and gives it an accuracy score. If the score is above 85%, we confirm it as a missed fee. Matches between 65% and 85% are flagged as suspected, while anything below 65% simply goes back into tracking until more evidence appears.

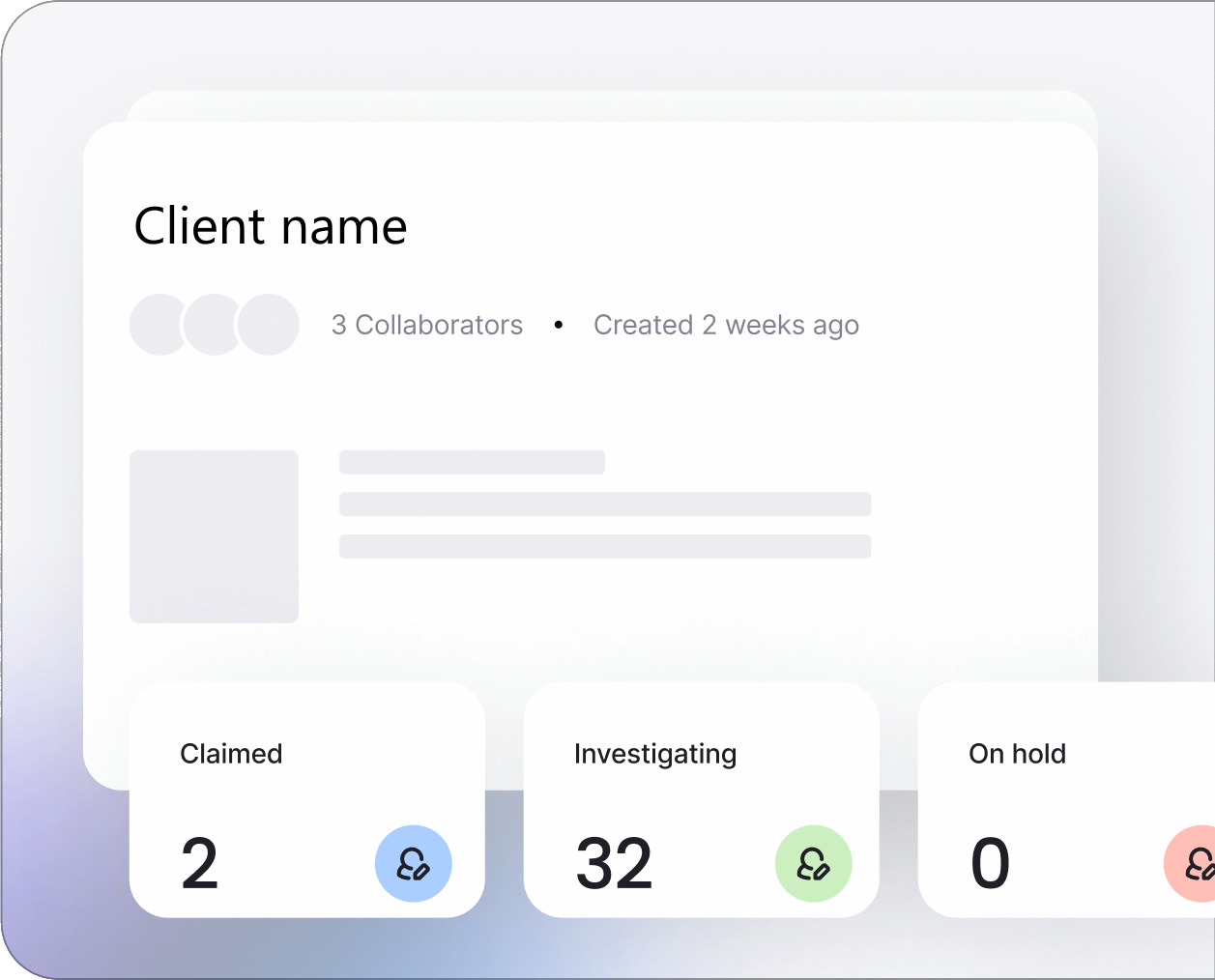

Take action & measure ROI: turn insights into results

When a missed fee is found, your team can act - claim, investigate, or monitor. Track revenue recovery and ROI in real time.

Check out our Revenue Protection Guide in blog for more ideas!

bobcheck features

Where bobcheck adds value

on top of Bullhorn

Built for

real world scale

Bullhorn captures recruitment activity as agencies grow and increase volume

- bob stops the leaks

Complexity grows

with success

More people, processes and systems naturally introduce variation, timing gaps and edge cases over time

Small gaps

reduce visibility

Minor inconsistencies across placements, extensions and billing can quietly limit insight for finance and leadership

Independent insight

not hindsight

bobcheck reviews Bullhorn data independently, highlighting patterns early so teams act with confidence

How does bobcheck work?

Connect & import CV data

bobcheck connects seamlessly to Bullhorn via tried & tested API and imports your past year’s CV data. This means any outstanding missed fees can be spotted immediately.

Candidate Tracking

Every day from setting up bobcheck, Bob monitors candidate movement in the background, so nothing slips through. CVs are tracked for 12 months and you're alerted if the candidate goes ‘behind our back’.

AI algorithm runs alongside

bobcheck’s AI reviews every candidate match and gives it an accuracy score. If the score is above 85%, we confirm it as a missed fee. Matches between 65% and 85% are flagged as suspected, while anything below 65% simply goes back into tracking until more evidence appears.

Take action & measure ROI: turn insights into results

When a missed fee is found, your team can act - claim, investigate, or monitor. Track revenue recovery and ROI in real time.

Check out our Revenue Protection Guide in blog for more ideas!

Claimed

2

Investigating

32

No action

0

Why Bullhorn Customers Use Us

It complements Bullhorn, not replaces it

bobcheck is built specifically for Bullhorn users who want greater confidence in placement, billing and revenue data without changing how Bullhorn is used.

It improves visibility for finance teams

By analysing Bullhorn placement and billing data independently, bobcheck helps finance and leadership teams validate outcomes without manual reconciliation.

It scales with growing agency complexity

As recruitment agencies increase placement volume, contract types and extensions, bobcheck maintains oversight without adding operational process.

It delivers fast return on investment

Most Bullhorn agencies uncover missed revenue, data issues or billing risk within the first few months of using bobcheck.

Designed for Bullhorn recruitment agencies

bobcheck is used by recruitment businesses that rely on Bullhorn as their core ATS and CRM and want additional assurance as they scale.

It is well suited to agencies with

• Temporary, contract and permanent recruitment revenue

• Multi office or multi brand structures

• Dedicated finance and operations teams

• High placement, extension and timesheet volumes

If Bullhorn underpins your billing, payroll and reporting, bobcheck adds confidence to every commercial outcome.

What bobcheck is and is not for Bullhorn users

What bobcheck is

• A revenue protection layer built for Bullhorn

• Read only and non invasive

• Focused on insight, validation and assurance

What bobcheck is not

• A replacement for Bullhorn

• Another ATS or CRM system

• A process or workflow overhaul

bobcheck exists to strengthen Bullhorn, improve data confidence, and protect the revenue agencies have already earned.